illinois payroll withholding calculator

If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. Unemployment IL UI 3_40 Employers Contribution and Wage Reporting.

Illinois Paycheck Calculator Smartasset

Then add to the wages paid to the nonresident alien employee for the payroll period the amount for the applicable type of Form W-4 and payroll period.

. Instead you fill out Steps 2 3 and 4. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Use tab to go to the next focusable element.

IL-941 Illinois Quarterly Withholding Income Tax Return. Claim withholding in the state of residence. This report is a good source of information used to balance wages and taxes withheld from prior quarters.

Illinois has a reciprocal withholding agreement with these states. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. University Payroll is responsible for ensuring that the University is in compliance with numerous Federal and State laws and regulations relating to the withholding of employment taxes on various types of remuneration including payments made to nonresident aliens student FICA exceptions and fringe benefits such as tuition waivers.

Illinois Hourly Paycheck Calculator. Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

If you are in a rush or simply wish to browse different salaries in Illinois to get an idea of how Federal and State taxes affect take home pay you can select one of our pre-built salary example for Illinois below. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. 2022 Federal Tax Withholding Calculator.

Free Federal and Illinois Paycheck Withholding Calculator. The Waiver Request must be completed and submitted back to the Department. Social Security and Medicare.

Tax Withholding Allowance Certificates. Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right. Determine taxable income by deducting any pre-tax contributions to benefits.

This return is a good source of information to use to balance employee gross wages paid and employer contributions made in prior quarters. Calculates Federal FICA Medicare and withholding taxes for all 50 states. The calculator above can help you with steps three and four but its also a good idea to either double-check the calculator by using the payroll tax rates below or save time and effort by using a reliable payroll service.

2022 Federal Tax Withholding Calculator. All you have to do is enter wage and W-4 information for each employee and our calculator will process your gross pay net pay and deductions for federal taxes as well as Illinois state taxes. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances claimed.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. If you are married but would like to withhold at the. Salary paycheck calculator guide.

How to calculate net income. Thursday Friday June 16 17 for our two-day seminar and Annual Members Meeting. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our Taxpayer Assistance Division at 1 800 732-8866 or 1 217 782-3336.

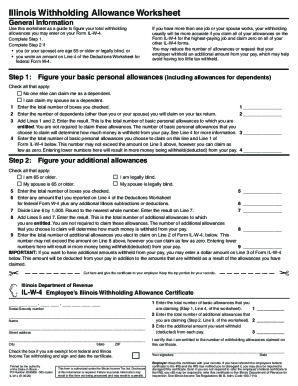

To determine the correct number of allowances you should claim on your state Form IL-W-4 complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. Occupational Disability and Occupational Death Benefits are non-taxable.

Should I adjust my payroll withholdings. 495 Basic allowance IL-W-4 line 1. University Payroll will withhold state tax for the reciprocal state and forward the tax to the appropriate state.

Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are essential to payroll. In Illinois the Termination notice is the same form as the Income Withholding for Support notice HFS 3683 and specifies the date on which withholding should stop. The Illinois Department of Healthcare and Family Services or the issuing agency sends the employer the following forms as applicable.

This free easy to use payroll calculator will calculate your take home pay. Illinois Payroll Withholding Effective January 1 2022. The Illinois State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Illinois State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Each April many taxpayers are surprised as they realize that they have either over withheld or under withheld on their taxes. If you claimed exemption from withholding on Federal Form W-4 you still may be required to have Illinois income tax.

This is a projection based on information you provide. Supports hourly salary income and multiple pay frequencies. Federal Payroll Tax Rates.

Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Illinois Salary Paycheck Calculator. The Illinois Department of Revenue is responsible for publishing the latest Illinois State. Latest W-4 has a filing status line but no allowance line.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. This Illinois hourly paycheck calculator is perfect for. Submit Form IL-W-5-NR Statement of Nonresidence in Illinois to University Payroll to claim the reciprocal withholding.

If the nonresident alien employee was first paid wages before 2020 and has not submitted a Form W-4 for 2020 or later add the amount shown in Table 1 to their wages for calculating federal income tax withholding. Alternatively use the Illinois State Salary Calculator and alter the filing status number of children and other taxation and payroll factors as required to produce your own. Illinois withholding effective January 1 2021 Federal withholding tax table Paycheck Calculator Paycheck Withholding Changes Withholding Tax.

We Solve Tax Problems Debt Relief Programs Tax Debt Payroll Taxes

What Is A Fair Tax For Illinois Seiu Local 73

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

2020 2022 Form Il Il W 4 Fill Online Printable Fillable Blank Pdffiller

Illinois Minimum Wage 2022 Increase Eder Casella Co Certified Public Accountants

Calculating Withholdings When Hiring Workers

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

Solved Illinois Schedule Cr Credit For Taxes Paid To Ot

Illinois Minimum Wage Increasing In January Eder Casella Co Certified Public Accountants

The Illinois Fair Tax Explained Levenfeld Pearlstein Llc

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

Payroll Software Solution For Illinois Small Business

The Caucus Blog Of The Illinois House Republicans Calculating Estimated State Taxes During Covid 19 Pandemic

Doc S Consulting Ltd On Twitter Income Tax Irs Taxes Types Of Taxes

The Illinois Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings